Now that is a god damn unpopular opinion, but I feel like it’s worth downvoting because unpopular opinion does not imply the op should be a dick about it.

Fuck capitalism, the world may never recover from our obsession with it

Now that is a god damn unpopular opinion, but I feel like it’s worth downvoting because unpopular opinion does not imply the op should be a dick about it.

Fuck capitalism, the world may never recover from our obsession with it

I have the aeron, it’s nice but a bit uncomfortable if you sit in it in any sort of non standard way, I sit with my legs crossed and my cat in my lap and unless I pad the heck out of the bottom with extra pillow or blanket the hard plastic digs into my feet and legs.

For me a far more comfortable approach is a monitor on a stand and a comfortable easy chair, along with a split ergonomic bluetooth keyboard. Embrace our wall-e future

Suicide before Alzheimers, on my own terms 🫡

I think easier access to emancipation would be incredible, when I was a teen in a bad situation I didn’t even know it was an option.

Perhaps the frontal lobes aren’t developed, but is that really a reasonable argument against freedom of action? Are we saying people who have less intelligence should not be given freedom? Why is the age 18 instead of 25? I think that’s a bad argument.

Haven’t been following lately, mistral was the best unrestricted model when I was on the scene a bit ago

I’m nihilistic so keep that bias in mind with the rest of this:

Life is a beautiful nightmare. Death is inevitable and worrying about it does nothing positive for you. Enjoy the peace of mind that comes with accepting death before it comes 👍

Cherry picking verses is not the same as refuting an argument. The books say many things that are not practiced. In reality children are in fact taught to rely on supernatural powers.

To prove my point:

Say “Nothing will befall us except what Allah has decreed for us; He is our Protector.” Let the believers, then, put all their trust in Allah. -Quran, 9:51

“Trust in the LORD with all your heart, and do not lean on your own understanding. In all your ways acknowledge him, and he will make straight your paths.” -Proverbs 3:5-6

Eh the general consensus is that this launch is a small early adopter phase and they have cheaper versions in the pipeline. They’re only producing <100k units, definitely not going for mass adoption yet

摆烂 bai3lan4

A slang term that means “stop striving”, I’d say it’s loosely akin to the phrase “quiet quitting” but a bit more general.

Hmm, maybe a useful feature in lemmy would be to ignore votes by users who voted up a specific post, like a user configurable anti vote manipulation feature. Because this post is incredibly obviously artificially upvoted

I would say we all have thoughts without language with varying levels of frequency, think about moments where you or others have said “ah i know what I want to say but forgot the word”

Insightful, I’ve found that most people change their answers at least slightly after having time to observe their thoughts for a while, we are geniuses at believing our own conjectures.

Not everyone does, I’ve had a lot of conversations with a lot of people on this topic.

People’s thought processes range from monologue to dialog to narration to silence to images to raw concepts without form.

I personally do not have a constantly running monologue, but rather have relatively short bursts of thought interspersed with long periods of silence.

They terk er jerbs

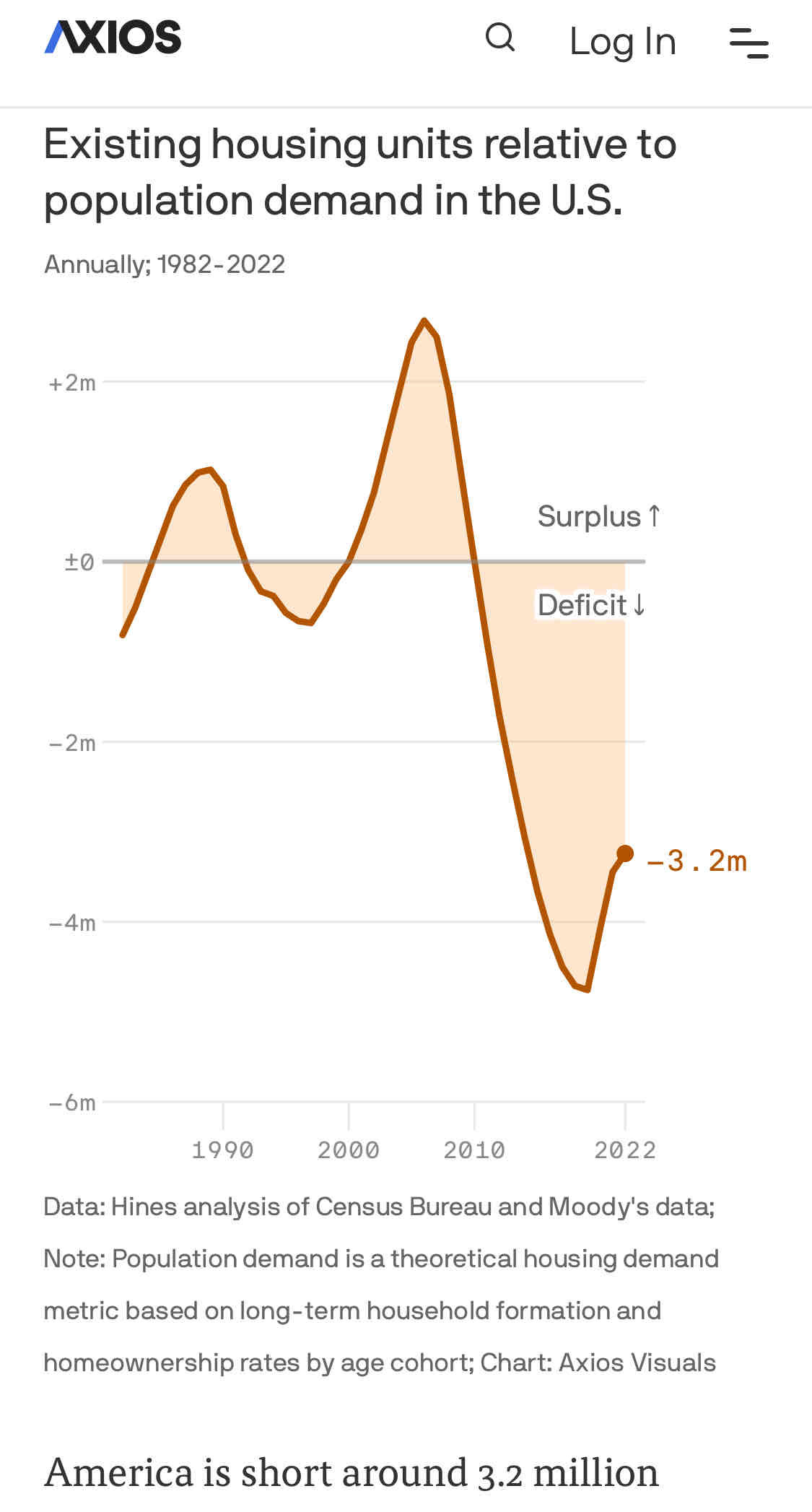

Investors, and not just mega corporations, local investors are a major issue.

We have collectively come to understand the idea that you can get free money by buying houses and renting them out. If you talk to any lay person and ask them how they’d spend a million dollars the most common answer seems to be “buy property”

Our issue is in our collective minds, but the inertia of the idea means it will probably never be fixed unless there’s a catastrophe

Tldr; there’s a housing shortage because… there are not enough houses being built

if everything is classical, a whole lot of stuff is going to be tough to explain like quantum superposition as it’s used in modern qubits, or quantum tunneling experiments that have proven effective. Heck I’m even interested in the double slit experiment explanation in the context of these fluctuations from the paper

I don’t disagree that spending less on transportation helps to save for a down payment. Finding inexpensive and reliable cars is not an easy task, but for people who were lucky, like myself, to find one it makes one chunk of the budget easier to stomach.

I own a home, so I’m not speaking from a place of woe is me, but from a position of empathy.

Don’t forget you have to qualify for your mortgage, even if you have a downpayment. Lenders will let you spend up to a max of 43% (and most far less than that) of your pretax income on your mortgage payment. If you’re the average household, 6275 * .43= $2698.25 monthly maximum payment. The average home price is $420,385 as we established earlier. Minus our down payment you could almost (but not quite) afford the loan with a PITI of 43%, the new payment would be around $2700/month with interest rates as they are today around 7.5%. But let’s say you are above average income wise for the sake of the narrative.

Oh shoot, $2700/month? That changes our household budget, now you’re spending at least an extra $800/month not including maintenance, utilities, and the many other expenses that come with home ownership. If you take that money out of your transportation budget you’re left with $300/month, hope you don’t have any surprise expenses! If your property taxes go up you have to give up something to afford it. Lose your job, lose your house. Paycheck to paycheck for the next 30 years, sounds like a nightmare to me.

On top of that affordability is getting worse, living expenses are rising, wages aren’t rising as quickly, the average person who didn’t luck into a home already will be less and less likely to afford one.

One thing to consider, if this turned out to be accepted, it would make it much harder to prosecute actual csam, they could claim “ai generated” for actual images