- cross-posted to:

- privacy@lemmy.ca

- cross-posted to:

- privacy@lemmy.ca

cross-posted from: https://slrpnk.net/post/15995282

Real unfortunate news for GrapheneOS users as Revolut has decided to ban the use of ‘non-google’ approved OSes. This is currently being posted about and updated by GrahpeneOS over at Bluesky for those who want to follow it more closely.

Edit: had to change the title, originally it said Uber too but I cannot find back to the source of ether that’s true or not…

To be fair this actually provides a very high level of security? At least in my experience with AIB (in Ireland) you needed to enter the amount of the transactions and some other core details (maybe part of the recipient’s account number? can’t quite recall). Then you entered your PIN. This signed the transaction which provides very strong verification that you (via the PIN) authorize the specific transaction via a trusted device that is very unlikely to be compromised (unless you give someone physical access to it).

It is obviously quite inconvenient. But provides a huge level of security. Unlike this Safety Net crap which is currently quite easy to bypass.

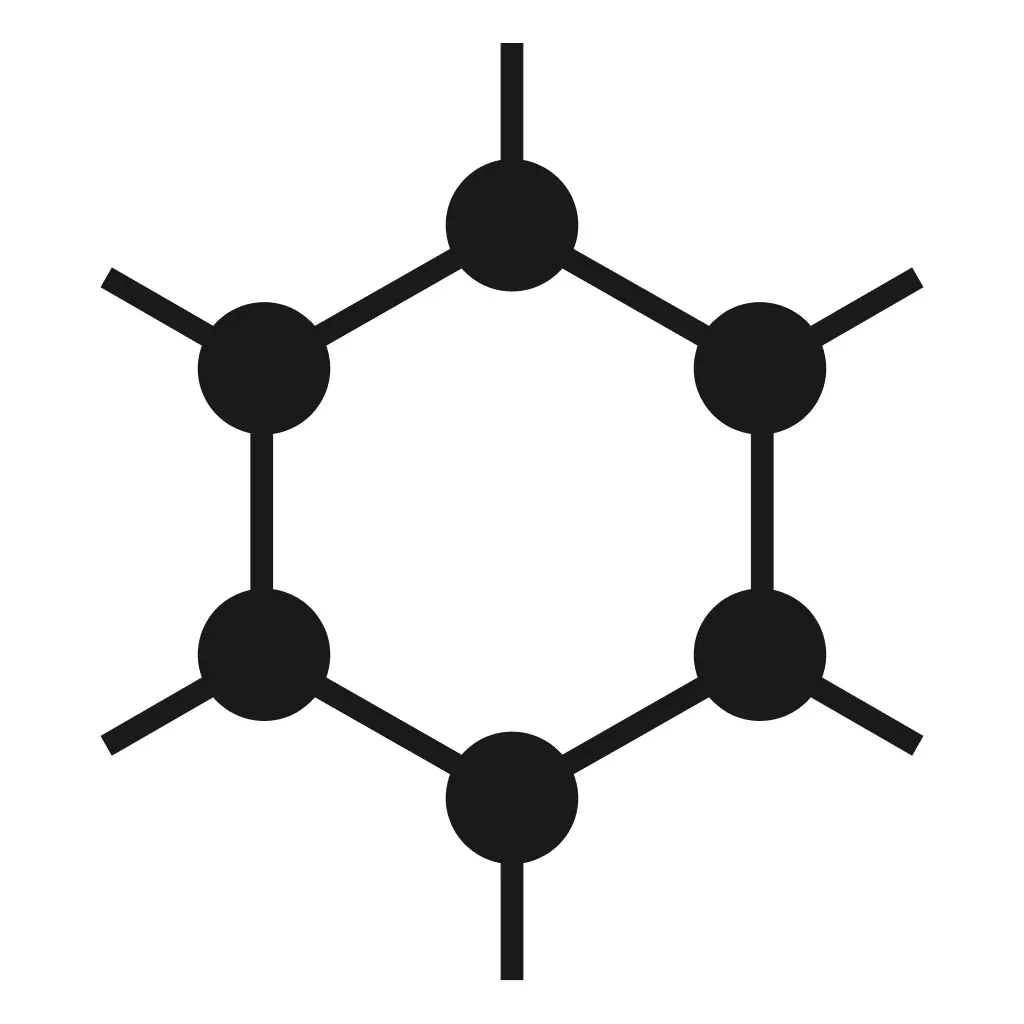

Those little boxes are just a bit of hardware to let the smartchip on the smartcard do what’s called challenge-response authentication (in simple terms: get big long number, encode it with the key inside the smartchip, send encoded number out).

(Note that there are variants of the process were things like the amount of a transfer is added by the user to the input “big long number”).

That mechanism is the safest authentication method of all because the authentication key inside the smartchip in the bank card never leaves it and even the user PIN never gets provided to anything but that smartchip.

That means it can’t be eavesdropped over the network, nor can it be captured in the user’s PC (for example by a keylogger), so even people who execute files received on their e-mails or install any random software from the Internet on their PCs are safe from having their bank account authentication data captured by an attacker.

The far more common

two-way-authenticationedit: two-channel-authentication, aka two-factor-autentication (log in with a password, then get a number via SMS and enter it on the website to finalize authentication), whilst more secure that just username+password isn’t anywhere as safe as the method described above since GSM has security weaknesses and there are ways to redirected SMS messages to other devices.(Source: amongst other things I worked in Smart Card Issuance software some years ago).

It’s funny that the original poster of this thread actually refuses to work with some banks because of them having the best and most secure bank access authentication in the industry, as it’s slightly inconvenient. Just another example of how, as it’s said in that domain, “users are the weakest link in IT Security”.

You had me until banks are secure. Most banks use 2FA over SMS. All banks in the EU require a phone number for PSD2 requirements.

With GPG and TOTP support, its been easier to secure s Facebook or google account better than 99% of bank accounts

I literally said 2FA over SMS is not secure because of weaknesses in the GSM protocol.

It’s still more secure than username + password alone, but that’s it.

Sure, but afaik all EU banks require a phone number so they can send OTPs using your phone for transaction auth. This is a mandate of PSD2.

My disagreement is with your last paragraph. Because of this regulation, banks are horrendously insecure. If I refuse to enter a phone number when signing up for a bank account, I literally cannot get a bank account in Europe. That’s insecure despite the user, not because of the user.

It think you’re confusing security (in terms of how easy it is to impersonate you to access your bank account) with privacy and the level of requirements on the user that go with it - the impact on banking security of the bank having your phone number is basically zero since generally lots individuals and companies who are far less security conscious than banks have that number.

That said, I think you make a good point (people shouldn’t need a mobile phone to be able to use online banking and even if they do have one, they shouldn’t need to provide it to the bank) and I agree with that point, though it’s parallel to the point I’m making rather than going against it.

I certainly don’t see how that collides with the last paragraph of my original post which is about how the original thread poster has problems working with banks which “require a separate device that looks like a calculator to use online banking” which is an element of the most secure method of all (which I described in my original post) and is not at all 2FA but something altogether different and hence does not require providing a person’s phone to the bank. I mean, some banks might put 2FA on top of that challenge-response card authentication methods, but they’re not required to do so in Europe (I know, because one of the banks in Europe with which I have an account uses that method and has no 2FA, whilst a different one has 2FA instead of that method) - as far as I know (not sure, though) banks in Europe are only forced to use 2FA if all they had before that for “security” was something even worse such as username + password authentication, because without those regulations plenty of banks would still be using said even worse method (certainly that was the case with my second bank, who back in the late 2010s still used ridiculously insecure online authentication and only started using 2FA because they were forced to)

Transmitting an OTP to the user is a security risk.

Banks in the EU are, in fact, forced to implement 2FA using phone numbers as part of “dynamic linking” requirement of PSD2, which makes more secure methods of 2FA (like TOTP) not allowed

Ah, I see.

Your point is that the use of a secondary channel for a One Time Pass is still an insecure method versus the use of a time-based one time password (for example as generated in a mobile phone app or, even more secure, a dedicated device). Well, I did point out all the way back in my first post that SMS over GSM is insecure and SMS over GSM seems to be the secondary channel that all banks out there chose for their 2FA implementation.

So yeah, I agree with that.

Still, as I pointed out, challenge-response with smartchip signature is even safer (way harder to derive the key and the process can actually require the user to input elements that get added to the input challenge, such as the amount being paid on a transfer, so that the smartchip signs the whole thing and it all gets validated on the other side, which you can’t do with TOTP). Also as I said, from my experience with my bank in The Netherlands, a bank using that system doesn’t require 2FA, so clearly there is a bit more to the Revised Payment Systems Directive than a blanked requirement for dynamic linking.

Oh the smart chip is best, its just not an option for CNP or bank transfers online

If you send a large wire transfer from your Dutch bank to an acffount outside the EU, I guarantee your bank is going to demand a transaction confirmation. 99% of the time that’s going to be a SMS, unleee you’re using their (closed source) app on your (insecure) phone

Do you use an app for your Dutch bank?

In Germany they’re called TAN generators if you want to learn more