- cross-posted to:

- news@lemmy.ml

- cross-posted to:

- news@lemmy.ml

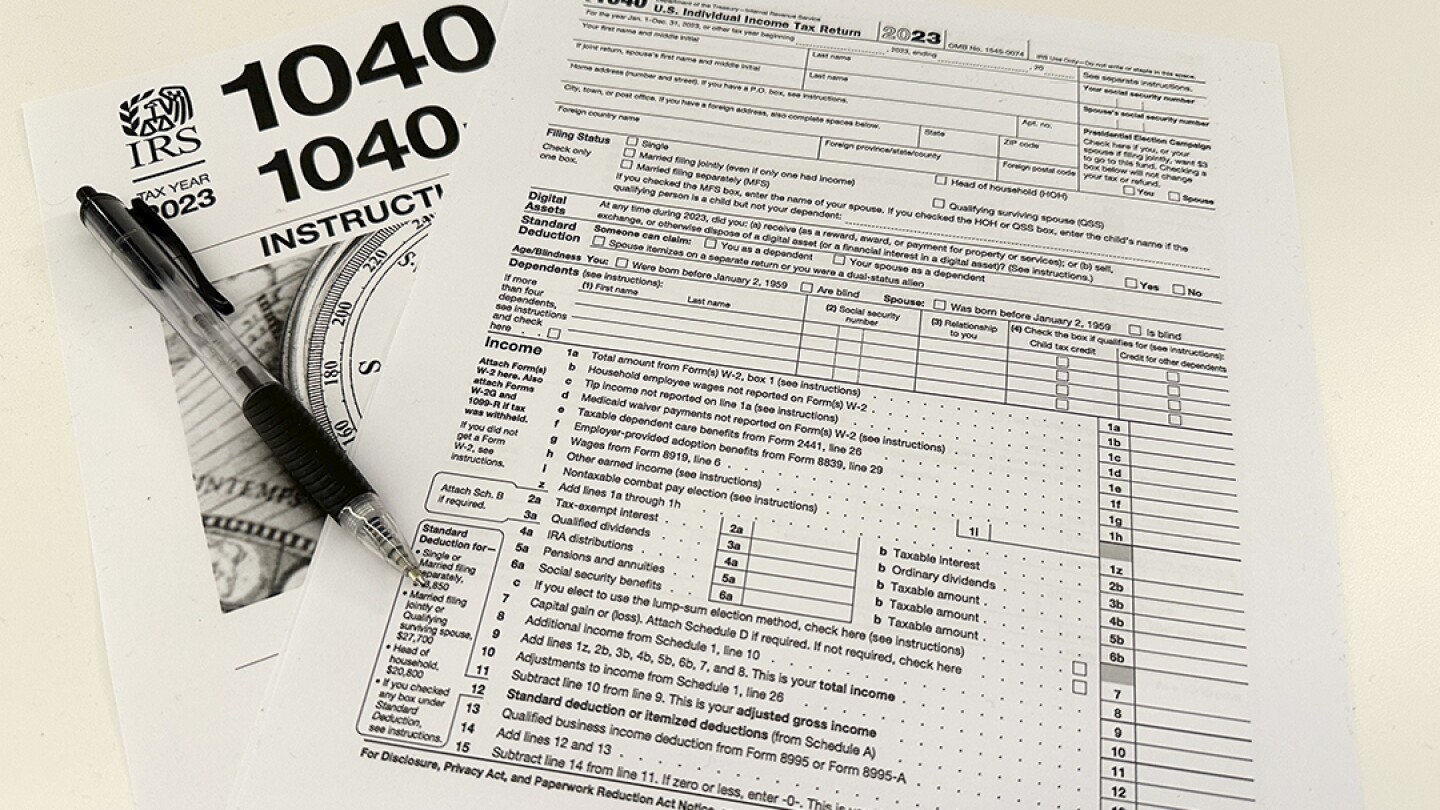

After weeks of testing, an electronic system for filing returns directly to the IRS is now available to taxpayers from 12 selected states.

The new system, called Direct File, is a free online tool. Taxpayers in the selected states who have very simple W-2s and claim a standard deduction may be eligible to use it this tax season to file their federal income taxes. The program will also offer a Spanish version, which will be available starting at 1 p.m. Eastern Time on Tuesday.

…

Certain taxpayers in Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming, Arizona, Massachusetts, California and New York can participate. Direct File can only be used to file federal income taxes, taxpayers from states that require filing state taxes will need to do so separately.

[Note]

Additionally, for all taxpayers, if you make $79,000 or less, the IRS has a list of free tax software you can use. Full list here: https://apps.irs.gov/app/freeFile/browse-all-offers/

This part of the article gave me a laugh.

Derrick Plummer, a spokesman for Intuit, said in an email that Direct File “is not free tax preparation but a thinly veiled scheme that will cost billions of taxpayer dollars to pay for something already completely free of charge today.”

“This scheme will cost billions of taxpayer dollars and will be unnecessarily used to pay for something already completely free of charge today,” Plummer said.

Dude… have you looked at your own product?

Hilarious. He said it, therefore he said it.

That part is funny too, but just the fact that the Intuit guy says that this is making people pay for a free service…

Oh yeah for sure. It was sued by the FTC for deceptive advertising of its free tax filing and had to pay a $141 million settlement in 2022.

ProPublica also had an article last month about its deceptive “free” service: https://www.propublica.org/article/ftc-intuit-turbotax-cease-deceptive-advertising-free-filing-taxes

He knows all about making people pay for a free service.

The only reason our tax return process isn’t fully automated is because of these lobbyists from scalpers like Intuit. Don’t ever let anyone tell you that private industry is always more efficient.

“This is competition for my product that costs taxpayers billions!”

I have gotten used to their projection by now, if a corpo or a gqp says something is illegal and makes sense, then they are the knes doing it

While I applaud this, there are A LOT of limitations this first round. Those eligible will be a very slim pool. For example these items exclude you:

- Paid for child care in order to work

- Made contributions to a retirement plan

- Had college tuition or other higher education expenses

- Paid for energy efficient updates to your home

- Are not married and over age 65 or disabled with an Adjusted Gross Income (AGI) between $13,850 and $17,500

- Bought health insurance through a marketplace (like HealthCare.gov)

- Withdrew money from a health savings account (HSA)

- Had tips

- Income received from payment apps, online marketplaces, or payment cards

- Income from independent contractor and gig work

- Income from rent, prizes, awards

- Need to report alimony

- Income from pension and retirement account distributions

- Additional limitations if your household income exceeds $125,000. You can’t use Direct File if your wages are more than $200,000 ($160,200 if you had more than one employer). [So two fillers with > $80K ea.? I don’t avidly understand this…]

- [In AZ] Receive the Arizona Families Tax Rebate in 2023 (most Arizona families with children received the Rebate in late 2023)

It seems they’ve managed to eliminate a significant number of taxpayers here, from all income levels. It also appears the state income tax rules play in significantly, which is strange to me- but then I guess the IRS needs their cut if you got money back from the state…. Any way, that will be a lot of upkeep for 50 sets of rules and situations, just to start.

If they can’t pull this off for everyone those left behind will find it very tedious or expensive to do their taxes, as this will likely shrink the base of available commercial options.

So basically, claiming any of the most common credits. I count five that I’ve claimed in the past few years (though not all five in one year).

But given that this is just the first run, I think they’ll expand it for next year. Better to have even some people using it now, than to not let anyone use it until it handles all cases.

The more you describe it as “cutting who is covered across all income levels”, the more it sounds to me like they are trying to keep it small to make sure they don’t roll out something totally broken that tons of people are relying on. Like a closed beta almost.